By Lene M.P. Hansen and Micol Pistelli

This blog post has been adapted from a recent post published by the European Microfinance Platform.

Well-coordinated public-private partnerships can significantly advance financial inclusion for forcibly displaced persons and their host communities. To be successful, these partnerships require an alignment of business interests, which does not always happen: humanitarian sectors focus on immediate aid, development agencies on long-term poverty reduction, and the private sector on profit. Host governments, often facing fiscal constraints, must prioritize cost-effectiveness and citizen well-being. Finding common ground and bridging gaps in terminology, priorities, and funding is challenging, but progress is being made.

It is widely accepted that using markets as shared platforms can improve the well-being of refugees and host communities and generate profit for the firms involved. However, it is challenging to support market systems in a way that makes them stronger, more inclusive, and more environmentally sustainable without distorting them.

To make long-term public-private partnerships work in displacement contexts, the business benefits need to be clearer. We propose focusing on at least four key elements to broker better market-led partnerships:

1. Defining a shared problem

Effective partnerships start by identifying common problems and working on solutions together. In many host countries, restricted access to labour markets and entrepreneurship prevents forcibly displaced people from contributing to local economies.

By leveraging the strengths of all partners, stronger, more sustainable, and inclusive local economies can be built that improve the well-being of host communities and refugees. While humanitarian organizations offer on-the-ground insights, development agencies can provide analysis. The private sector can define sustainable business models and the data needed to demonstrate their viability, so they should be involved from the beginning.

Governments create the conditions for inclusive growth and effective market participation. Limiting access to work hinders self-reliance and increases dependency on aid, stressing social systems and fueling labour market informality. Addressing these issues can reveal where market solutions can be most impactful.

2. Defining common goals and contributions based on comparative strengths

All stakeholders in a partnership need to understand each other’s strengths and limitations and set common, measurable goals. These goals should focus on bringing positive changes for both refugees and host communities. By leveraging the strengths of partners, it is possible to create strong, sustainable, and inclusive local economies that improve everyone’s well-being.

For instance, humanitarian actors can look beyond immediate needs and plan for transitions to programming that supports longer-term development outcomes for displaced persons. Development actors can help map out market function and spot opportunities for improvement. The private sector can bring innovation, technology, and resources to fill gaps and provide inclusive labour market participation examples. Meanwhile, governments can design policies that drive economic transformation and inclusive growth and create incentives for the private sector, as the Shirika Plan in Kenya aims to do.

3. Building trust with policy anchors

Actors have different views on solutions for better socioeconomic inclusion and financial well-being. Partnerships thrive on principles of equality, respect, and shared accountability while addressing diverse perspectives and working towards agreed goals.

Strengthening partnerships involves organizing policy dialogues for direct engagement, helping review progress and suggesting improvements. Joint research identifies pain points and opportunities while sharing successes and lessons, like Colombia’s integration of Venezuelan refugees, showcases economic benefits. International agreements like the Kampala Declaration on Jobs, Livelihoods and Self-reliance and private sector initiatives like IKEA Group’s NESsT Refugee Employment Programme in Poland and Romania and the pan-African Amahoro Coalition highlight the transformative potential of market-based solutions for economic inclusion.

Effective partnerships require investing time and resources in relationship-building and fostering shared ownership, as seen in the IFC and UNHCR Joint Initiative, which is working to increase private sector engagement in displacement contexts and promote financial inclusion in Latin America and Europe. In addition, better communication and alliances with local partners, including refugee-led and community organizations, can further enhance sustainability and better collaboration.

Advancing financial inclusion and well-being for forcibly displaced persons through effective public-private partnerships is essential. By defining common goals, building trust, and leveraging the comparative strengths of all actors, we can create sustainable, inclusive local economies that improve the well-being of everyone involved.

4. Combine capacities to deliver outcomes sustainably and at scale

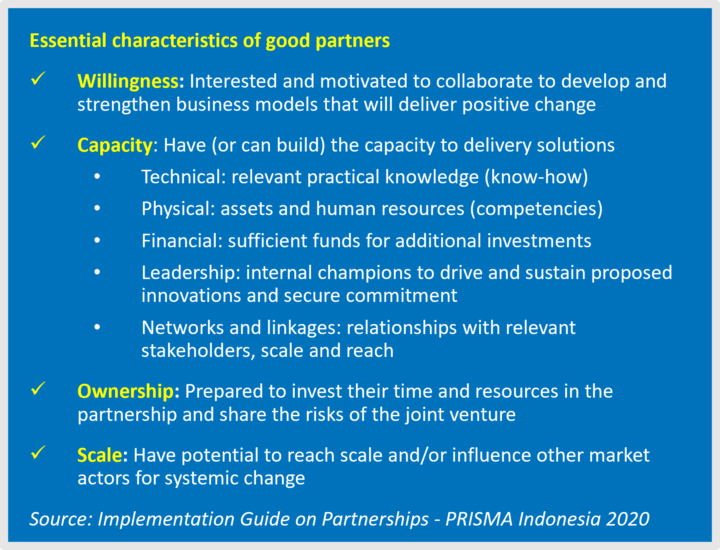

Partnerships need the right mix of capacities, which may evolve. These capacities include:

- Physical presence and networks: On-the-ground presence is crucial for reaching forcibly displaced people. Humanitarian organizations, with their field offices and networks of Refugee-Led Organizations and NGOs, offer real-life insights and logistical support to the private sector and development partners.

- Technical capacity: Expertise in financial technology, mobile banking, data analytics, and regulatory systems is critical for effective inclusion programmes. Support in financial education and technical aid to service providers is also crucial. The ILO’s financial education program for refugees and host communities and their training for financial service providers are examples of this support.

- Financial capacity: Adequate funding is essential for scaling inclusion initiatives. Impact investors, development financial institutions, and financial service providers can provide the resources to expand services and test new approaches. Blended finance and grants are increasingly popular. Successful partnerships need a willingness to invest, share risks, and work towards scalable solutions.

- Sharing perceived risks: Partnerships should share risks. Governments and development finance institutions can offer subsidies, concessional capital, and other risk mitigation tools for the private sector. For example, the blended finance programme in Uganda by SIDA, UNHCR, and Grameen Credit Agricole Foundation helped over 120,000 refugee and host entrepreneurs with funding. New initiatives like the Refugee Development Impact Bond in Jordan use private and public resources on a ‘repayment for results’ basis, allowing more flexible solution testing.

- Scalability: Partners should plan how to expand beyond pilot projects to reach scale across different regions and contexts. For example, at the most recent Global Refugee Forum, KIVA scaled their lending to displaced populations and aimed to provide an additional $40m in loans to at least 65,000 people by the end of 2025.

- Measuring outcomes: To know if a partnership is successful, outcomes must be measured. The Global Partnership for Effective Development Cooperation recently started the Kampala Principles Assessment process in Burkina Faso to improve private sector engagement. While measuring financial well-being is still developing, the annual 60-decibel Microfinance Index includes key indicators of financial health, which, as FIND research shows, can be segmented to track progress in displacement contexts.